Channels are an important part of technical analysis. There are quite a few channel trading methods that a trader can use. Some of these include Fibonacci Channels, Andrews Pitchfork, or Keltner Channels. Today we will discuss another important channel type, namely the linear regression channel. We will discuss its structure and see how it can be used to analyze charts.

What is a linear regression channel?

The Linear Regression Channel is a three-line technical indicator that displays the high, low and middle of the current trend. The indicator was developed by Gilbert Ruff and is often referred to as the Raff regression channel. The linear regression indicator is commonly used to analyze the upper and lower limits of an existing trend. It helps traders find optimal entry and exit points from the market.

The linear regression channel indicator consists of three parallel lines - the upper line, the lower line and the median line.

The upper regression line marks the tops of the trend. It is plotted through the highs on the chart. The bottom and middle lines will be parallel to the top line.

The lower regression line marks the bottom of the trend. It is built through the lows on the chart. The top and middle lines will be parallel to it.

The median regression line is the basis of the linear regression channel indicator. It shows the middle of the trend. The upper and lower lines are evenly spaced from the midline.

How can the indicator be used?

The linear regression channel can be used to determine the entry and exit points of the market. Every time you see price interaction with the upper or lower indicator line, you should be aware that price movement may change. In addition, when the middle line is broken, it means that an ongoing impulse wave is likely forming, which could provide a signal to continue the trend.

Another important signal that comes from the regression analysis is a possible breakout of the channel boundaries. When price breaks the linear regression channel in the opposite direction to the prevailing trend, it is a strong signal that a breakout of the regression channel could drastically change the direction of price.

Channel types

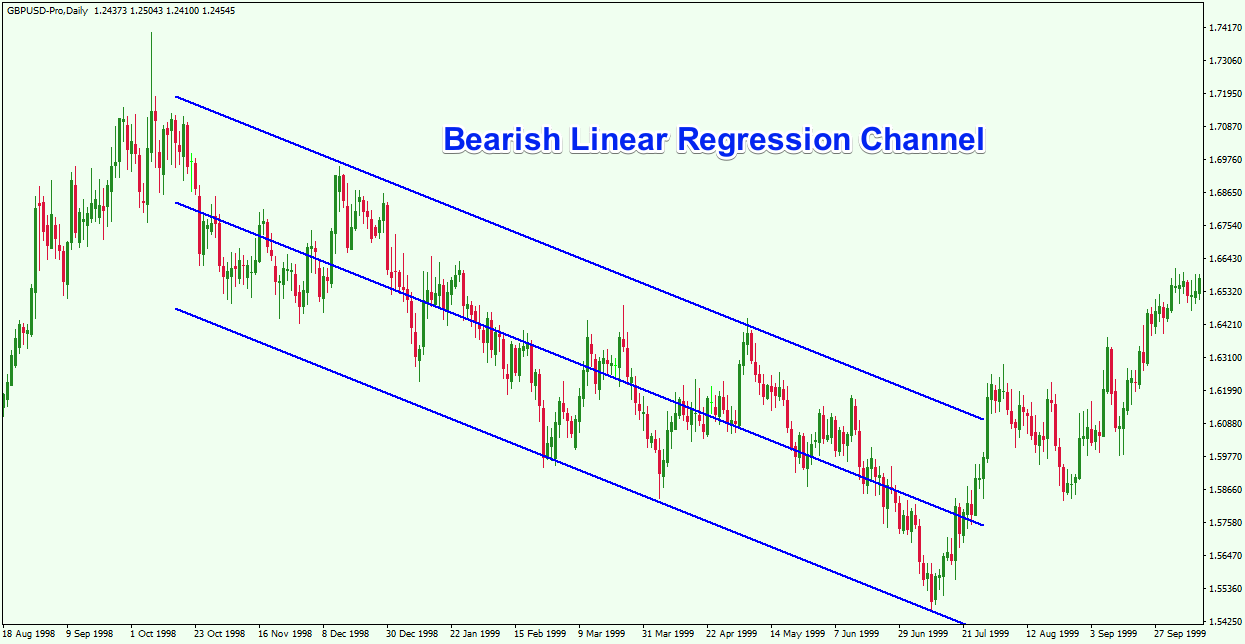

Depending on the direction of the trend, there are two types of linear regression channels - bullish and bearish. These two types of regression channels are determined based on the direction of price movement.

A bullish linear regression channel refers to bullish trends. In this case, the price rises and the slope of the linear regression increases. The trend is bullish and the indicator slopes up.

A bearish linear regression channel is the opposite of a bullish linear regression channel and refers to bearish trends. For a bearish scenario, the price declines, as does the slope of the linear regression.

How to use the linear regression channel indicator?

You will find a regression channel indicator built into most trading platforms, including MetaTrader. Let's see how to add this indicator to the chart.

First, you need to select an indicator from the MT4 platform menu. You can do this by going to the top of the MT4 window, then clicking Insert - Channels - Linear Regression. You have now selected the indicator and it is activated as a drawing tool.

Now you need to draw a linear regression channel. Select the beginning of the trend and stretch the indicator to another critical point in the trend. The three indicator lines will self-adjust based on the projected top and bottom of the trend. At the same time, the middle line will also automatically take its place between the upper and lower lines.

The main form of linear regression channel analysis is to observe the interaction of price with the three lines that make up the regression indicator. Every time price interacts with the upper or lower line, we can expect a potential price reversal on the chart. For swing traders, this means that you can enter the market after a price pullback in the direction of the trend and exit when the price approaches the opposite channel border.

Linear Regression Trading System

Let's take a look at a linear regression trading system that will help you plan and execute trades more efficiently.

To enter a linear regression trade, you can buy a trading instrument on the second bounce off the lower line of the indicator. The second touch is used to confirm the presence of a trend. As the bottom holds, a trend is likely to appear on the chart. Therefore, this time we will buy a trading instrument in an attempt to catch the upcoming bullish momentum.

Opening a bearish linear regression trade works the same way, but in the opposite direction.

If you are trading a bullish linear regression setup, a stop loss order should be placed below the swing low created by the price bouncing off the lower line of the indicator. Conversely, if you are trading a bearish linear regression, your stop loss should be placed above the swing high created by the price bouncing off the upper line of the indicator.

You have two options for making a profit using linear regression. The first option is to hold your trade until the price reaches the opposite linear regression level that we discussed in the previous example.

The second option is to hold the trade until the price breaks the middle line in the opposite direction to the prevailing trend. This means that if you are trading long, you can hold the trade until the price rises above the center line and breaks down. If you go short, you can close the trade when the price drops below the center line and then breaks up.

Of course, none of the linear regression trades should be made if the price breaks the channel in the opposite direction of the general trend.

The trade exit strategy you use with a linear regression channel should be based on your own preference and comfort level. Unfortunately, there is no one-size-fits-all solution here.